are union dues tax deductible in ontario

Therefore union dues may have to be adjusted retroactively. Prior to 2018 an employee who paid union dues prior may have been able to deduct them as unreimbursed.

Taxable Benefits Explained By A Canadian Tax Lawyer

5-64Union dues are tax deductible at source in all jurisdictions except Québec.

. ONA Dues Tax Treatment. No employees cant take a union dues deduction on their return. The chart below shows weekly OPSEU union dues calculated at 10 intervals.

If youre a teacher paying union dues only your dues toward negotiating pay and benefits can be deducted from your income taxes. Do part-time employees pay reduced union dues. Our dues are 1375 of your gross salary.

There are no initiation fees dues are tax deductible and you do not pay any union dues until you have bargained your first collective. There are no initiation fees dues are 100 tax deductible and you do not pay any union dues until you have. Portion of Dues for Insurance.

How much are union dues in Ontario. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. You can deduct dues and initiation fees you pay for union membership.

If the CRA asks for proof of which union your dues were paid to contact the payroll department of your employer and request a. These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form 1040 Itemized. You cannot claim charges for pension plans as membership dues even if your receipts show them as dues.

Prior to 2018 an employee who paid union dues may have been able to deduct unreimbursed employee business expenses. However if the taxpayer is self. Straight Time Hourly Rate.

Four years have passed since union dues havent been deducted from federal taxes and many lawmakers are attempting to bring it back and make it deductible without itemizing. If an above-the-line deduction for union dues were enacted now on a permanent basis workers and unions would not be caught up in the decision that Congress will face in. Total Deducted Per Month.

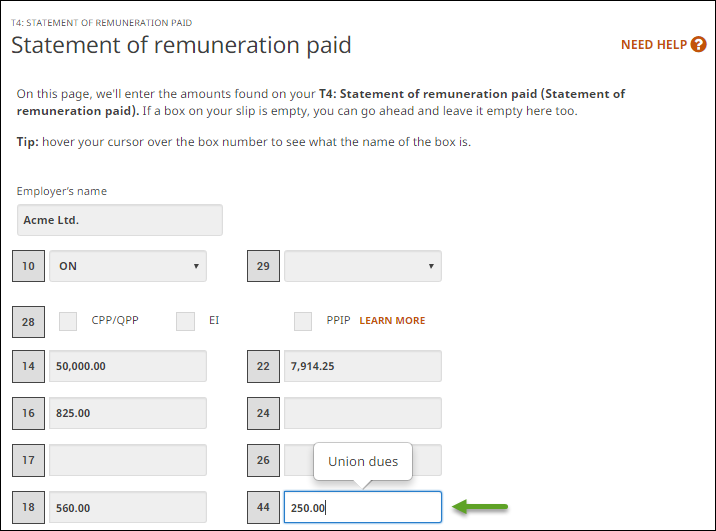

This should satisfy any CRA inquiries into your union dues. The amount shown in box 44 of your T4 slips or on your receipts includes any. We do more for you for less.

In accordance with the relevant collective agreement the. If youre a private-sector union member. You can deduct any union dues paid by you from your taxable income.

The dues are typically discounted as they may not be a full member but the amounts paid are 100 deductible in the year paid. Taxation of Union Dues. The TCJA made union dues non-tax deductible.

For example if your annual income is 40000 and you paid 1000 as union dues your taxable. Portion of Dues for Box 44 on T4 tax deductible Equal or. Dues are completely tax deductible.

Ad A Tax Agent Will Answer in Minutes. These union dues are currently 13 of gross earnings plus local levies where applicable and are deducted automatically from your pay cheque. Typically residents may only be a member of CPSO.

For more information refer to Chapter 5 Union dues are tax deductible at source in all jurisdictions. For more information please contact. Our dues are 1375 of your gross salary.

How To Claim Union Dues On The Tax Return Filing Taxes

Pay Stub Template 9 Free Pdf Doc Download Templates Printable Free Printable Checks Template Printable

Union Professional And Other Dues For Medical Residents Md Tax

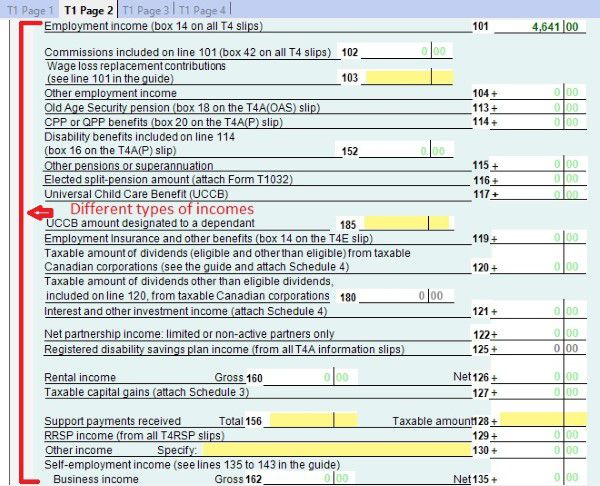

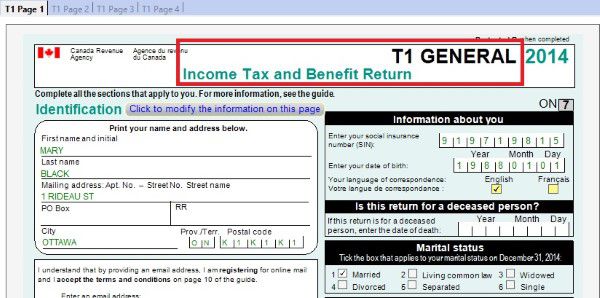

Understanding The Canadian Income Tax Benefit Return And Schedules

Where Do I Enter My Union And Professional Dues

4 Important Tax Rules For Holiday Parties And Gift Giving In 2021

Tax Course 8 Understand Individual Income Tax Return

Tax Terms And Definitions For Kids Mydoh

What Are The 2022 Tax Rates Brackets And Credit Limits In Ontario

3 Ways To Calculate Your 2021 Tax Instalments

Ontario Income Tax Calculator Wowa Ca

6 Overlooked Tax Deductions And Credits That Could Score You A Big Return National Globalnews Ca

Tax Course 8 Understand Individual Income Tax Return

2022 Canada Tax Checklist What Documents Do I Need To File My Taxes 2022 Turbotax Canada Tips