is a car an asset for fafsa

The FAFSA also has an asset protection allowance that shelters a portion of parent assets based on the age of the older parent. UTMA or UGMA accounts.

What To Do If You Re Selected For Fafsa Verification Nerdwallet

Prior to the 20212022 award year students convicted of a federal or state offense of selling or possessing illegal drugs that occurred during a period of enrollment while they were receiving federal student aid could lose access to title iv funding but were still encouraged to complete and submit the fafsa form because they may become eligible.

. Not your car and liquid meaning you can easily turn them. The home in which you live. This Federal Register notice shows that the asset protection allowance will drop to zero for single parents of all ages for the 2022-23 FAFSA.

UGMA UTMA accounts where you are listed as the custodian and do not own. Trusts for which you or the student are a. This balance is typically around 10000.

So using federal student aid funds such as the Federal Pell Grant and federal student loans to buy a car is not an allowable expense. No the FAFSA specifically does not ask about cars boats planes jewelry retirement accounts and the family home. NO its not an asset on the FAFSA but it is on the Profile.

The value of your life insurance. You still need to list your bank account totals as an asset. Money deposited in checking accounts and savings accounts Real estate.

Cash Savings Checking Account Balances When asked to list your and your spouse if applicable and your parents if applicable current cash savings and checking account balances DO respond with the combined amounts as of the date you are filing the FAFSA. How are assets treated on the FAFSA. 529s owned by your ex-spouse.

The maximum asset protection allowance however has decreased from 84000 in 2009-2010 to 9400 in 2020-2021 and will eventually disappear entirely. Any remaining assets are assessed on a bracketed scale from 264 percent to 564 percent. Other investments are reported on the FAFSA application including bank accounts brokerage accounts and investment real estate other than the primary home.

The PROFILE will ask about a family farm but once again schools will treat this asset will vary. The car also isnt reported as an asset on the FAFSA. Depending on the age of the older parent and the number of parents in the household this amount varies.

The car loan is not relevant to FAFSA calculations and cars are not an asset for their purposes. Retirement accounts are meant to be tucked away for later on in life so dont include them as assets. FAFSA assets looks at the money and other financial resources that both the students and their parents have.

And distributions from it are student income in the year theyre received. Separately it asks for income and tax return information from 2019. YES theyre an asset.

The FAFSA doesnt want to know about assets in a farm if it is the familys principal residence and the student andor parents materially participate in the farming operation. Edmit Guides Learning Center High School Seniors High School Juniors Early High School Saving for College College Financial Health Company About Edmit Press Pricing Our Data For Educators Blog Search Colleges. This would include 401K IRA pension funds and so on.

Likewise pensions 401 k plans IRAs and other qualified retirement plans are ignored. 1 Reply Share ReportSaveFollow level 2 Op 1 yr. The FAFSA does not factor in every dollar of a parent s assets.

What are Parent Assets on FAFSA. If your account balance falls below your Asset Protection Balance you will not have to report the account. The Free Application for Federal Student Aid FAFSA form asks for marital status as of today the day the form is filled out.

A number of other FAFSA assets should not be listed. Strategic Positioning of Assets Student assets are assessed more heavily than parent assets on the FAFSA. About 68 of families with college-age students fill out the FAFSA in.

Home maintenance expenses are also not reported as assets on the FAFSA since the net worth of the familys principal place. The reason the FAFSA asks the age of the older parent in the household is to use their asset protection allowance index by age. 03-06-2005 at 735 pm Reply 2 FastLane 131 replies 5 threads Junior Member.

Thats down from 3900 for age 65 and older last year and 32800 in 2009-2010. In several situations there is not a requirement to report your 529 Plan as an asset on the FAFSA. Can you spend extra fafsa money.

Report Cash On Hand Students must report any cash they have on hand including money in a savings or checking account and even cash stashed in. 1 is the priority deadline to submit the FAFSA in Missouri. According to the FAFSA a car a computer a book a boat an appliance clothing and other personal property is not included in the asset description.

Below is a list of assets you do not need to include when filing your FAFSA. However there are no controls to ensure that students do not use student aid to purchase a vehicle. YES theyre an asset specifically the students asset.

These cover parents assets on FAFSA. I wound up reaching out to my financial aid advisor and he said the same thing 1 Reply Share ReportSaveFollow. Assets on the FAFSA An asset is essentially any money that you have readily available.

A portion of parent assets are sheltered by an asset protection allowance that is based on the age of the older parent. Cars computers furniture books boats appliances clothing and other personal property are not reported as assets on the FAFSA. Its essential to understand how assets whether.

If you read each question carefully you will see they want cash and investments like money markets stocks bondsno where do they ask about cars. Is a car an asset for FAFSA. According to the FAFSA house maintenance expenses as well as the capital gains on the family residence are classified as part of the primary residence property asset category.

For the purpose of filling the FAFSA these are counted as assets. Other assets students and parents can leave off of the application include the value of cars and other vehicles such as boats or motorcycles. As a general rule you should only report assets that are cash-based ie.

What To Do If You Re Selected For Fafsa Verification Nerdwallet

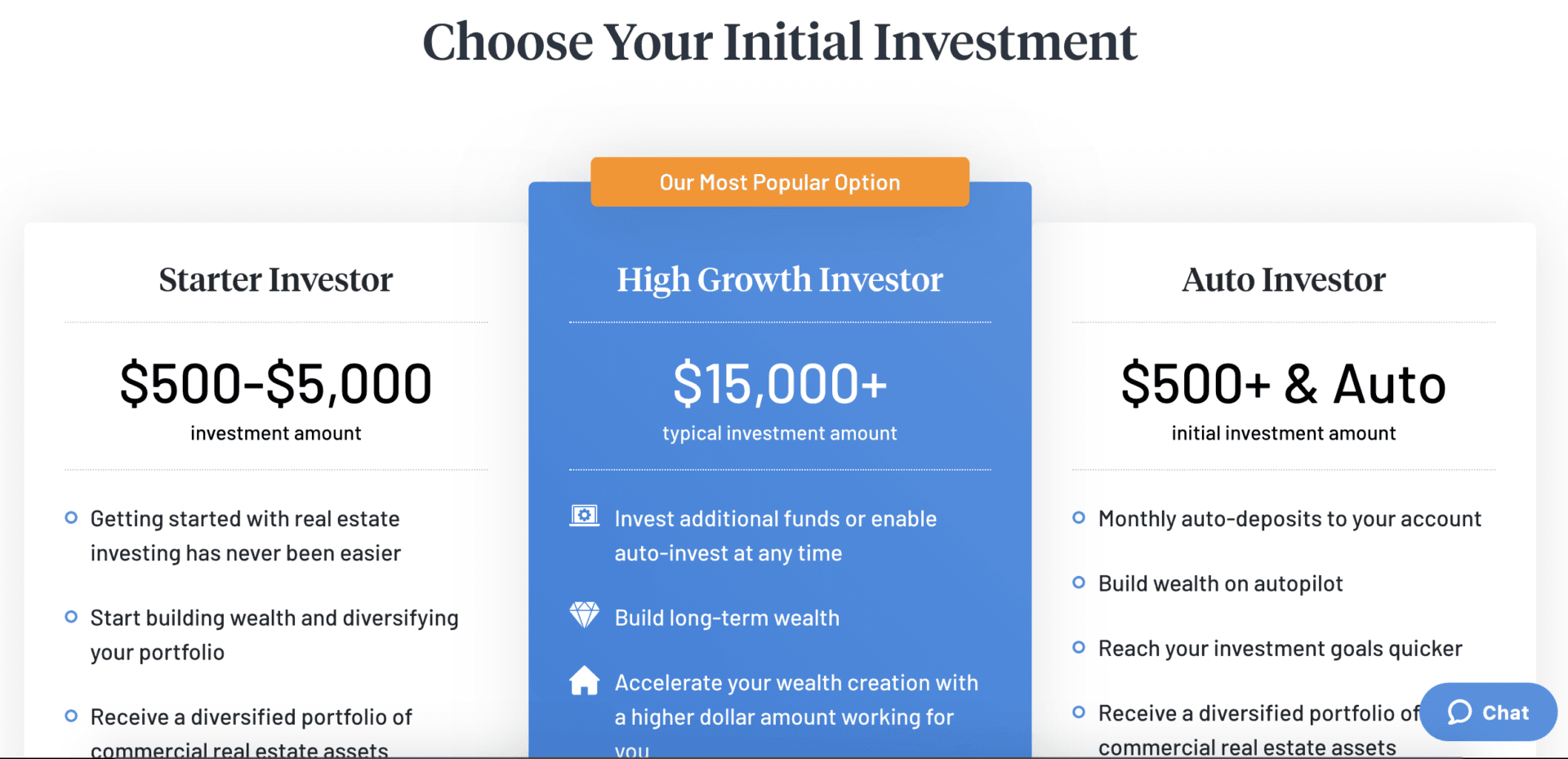

Diversyfund Review My Experience With Diversyfund

Pin By Utilitysavingexpert Com Ltd On Utility Saving Expert Gas And Electric Saving Energy